The Candle Stick Says…..

There are lots of Stock Traders out there that rely on Candlestick Patterns to trade. I don’t use them, as an absolute, but do use them regular to predict direction, or give me a hint as to what is next. Predicting the next few minutes if day trading or days if looking longer term.

So here are 3 quick lessons on Candlesticks.

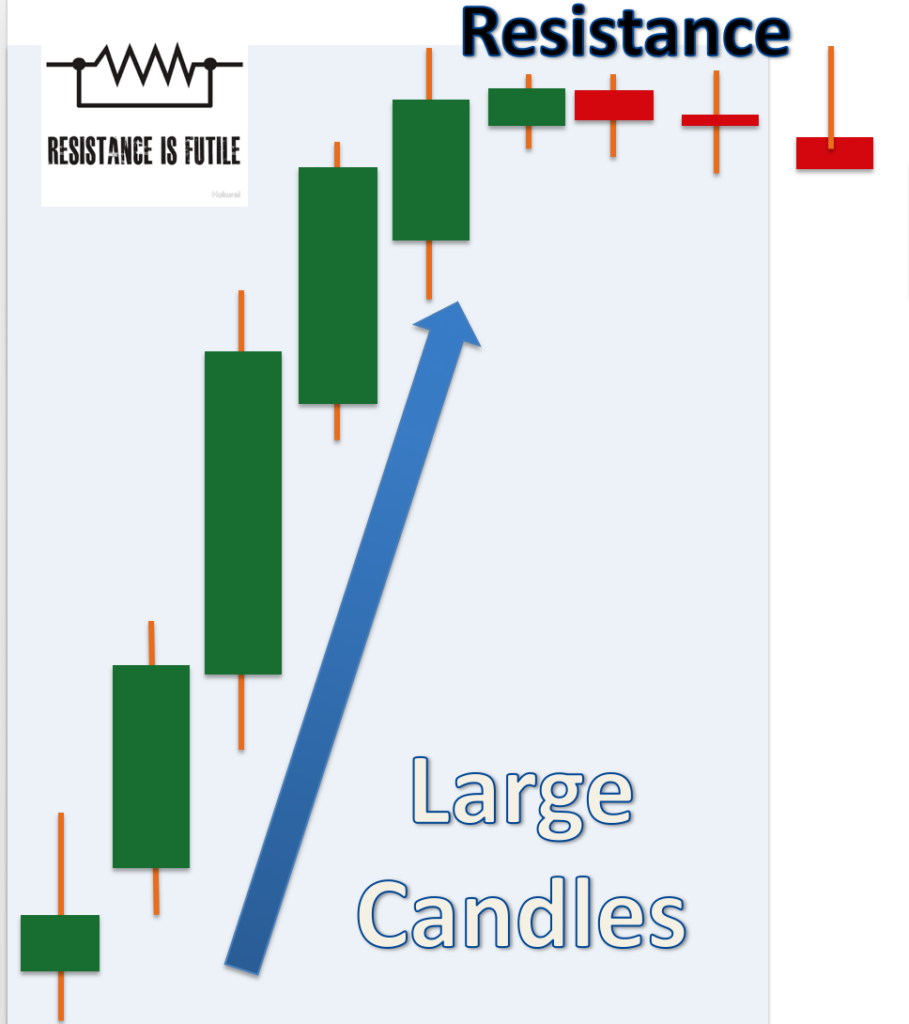

- Size of candle sticks. As the market gets close a support or resistance levels. The size of the candle stick will usually shorten. A hint the run up or the run down, is coming to end.

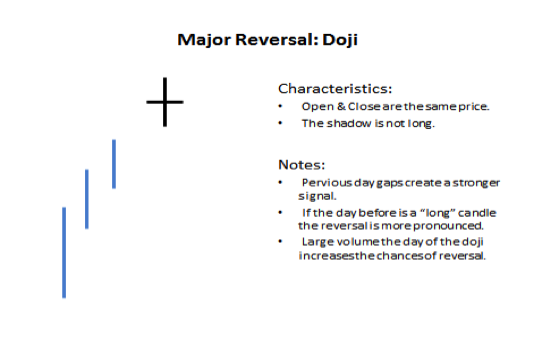

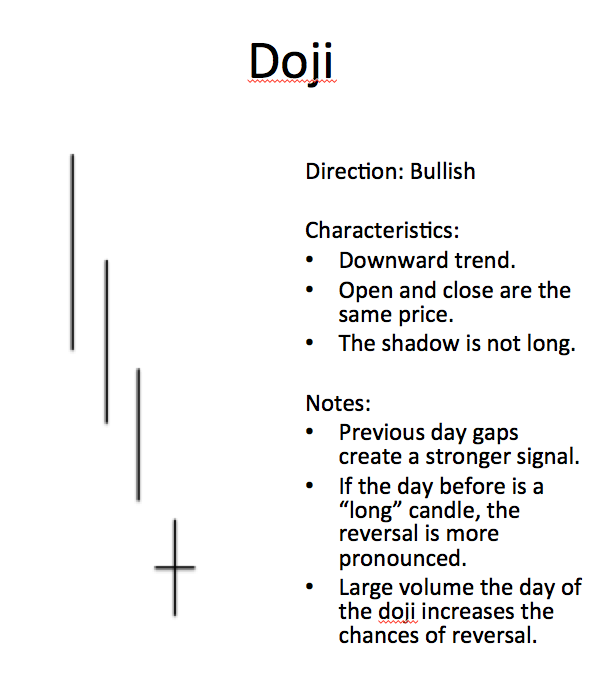

2. Doji. The CROSS, after a run up or a run down, is usually a sign of reversal of direction. So, if the market was running up, and then you see a CROSS, likely the next day, or period is going to be down. Not an absolute but a hint.

Same is true if going down.

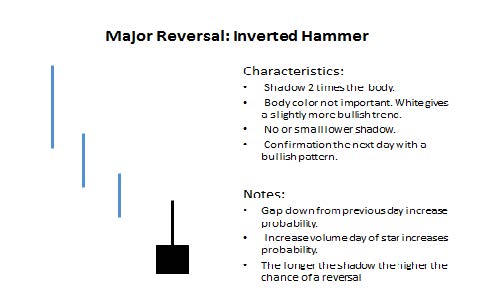

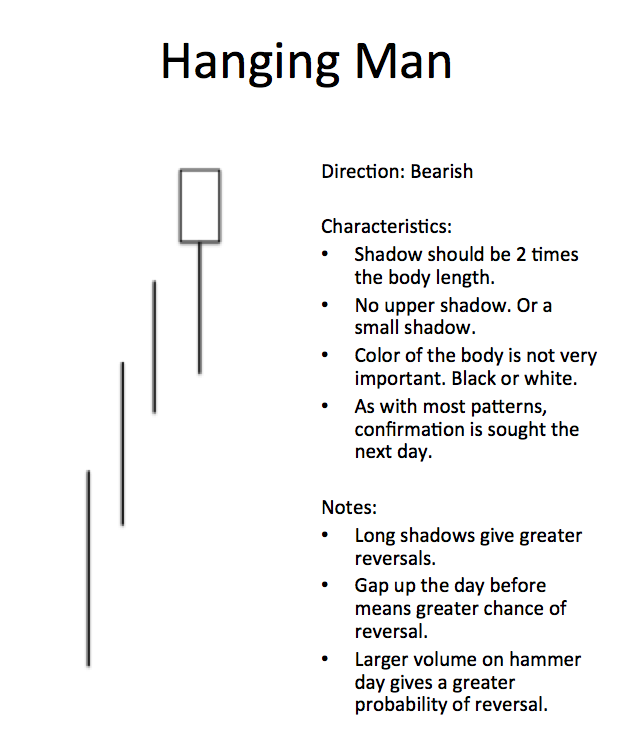

3. Hammers. The same is true of hammers after an uptrend or downtrend.

OFFER: Several years ago. I did something to help me, and students learn these patterns.

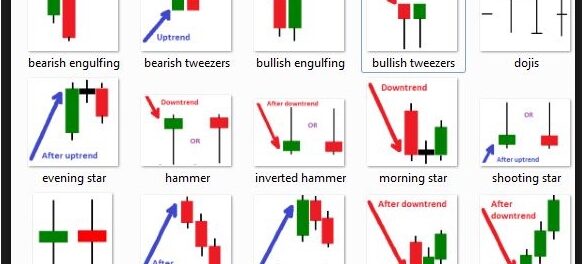

First, I have a cheat sheet with the 10 most common patterns, you must learn. I call them the Million Dollar patterns. Posted on my wall for years.

Second. I had my Son, Mike build me a Flash Card game. 70 of the Candle Stick patterns, for you to memorize over time. Take one a week for 1.5 years, and work with it. over time, you will become a Master.

If you are interested a set of 70 cards, is only $49 bucks. Go to http://www.finseminars.com