Day 45: Expire November Vertical Spead Options

Hi folks. Trade day for November Credit Spread options.

Some notes:

- Seasonal Patterns? Well, usually, sept is a down month 67 percent of the time, and guess what. It was. We anticipated OCT-Mid jan up. But remember, technicals are more important.

- 200/50-day moving average is still on an uptrend although converging (going sideways, and may move to the downside).

- 20/5 day moving average. Down.

- Charting channeling sideways after a downtrend. So “flagging” to the downside. About 62-68 percent of the time this will go down. 32-38. percent reversal.

- Support 1760. Resistance 1800.

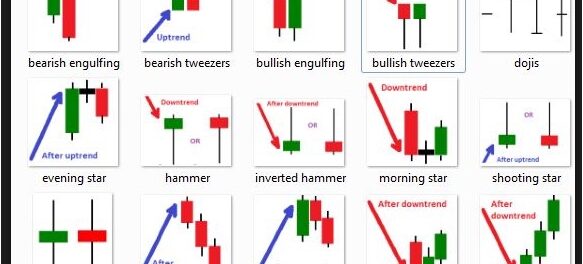

- Candlesticks. Piercing pattern to the downside.

Positions. Vertical Call at 1970/1980. for 30 cents. Waiting on VP. Pretty sure, it will be 1500/50 (50 spread), tried 1.80, 1.70. now at 1.60. Filled 1.60.

Positons. VCall 1970/1980 30 cents. VPut. 1500/50 for 1.50.

PS: remember. if u do a 50 buck spread that equal to 5 10 dollar spreads.